social security tax calculator

Get the most precise estimate of your retirement disability and survivors benefits. The self-employment tax rate is 153.

Social Security Calculator 2022 Update Estimate Your Benefits Smartasset

The Social Secuirty Administration SSA is likely to announce the 2023 Cost-of-living.

. The estimate includes WEP reduction. Social Security benefits are 100 tax-free when your income is low. SS benefit is between 232K 44K then taxable portion is 50 of your SS benefits.

Looking back the CPI for August. Social Security COLA 2023. For each age we calculate.

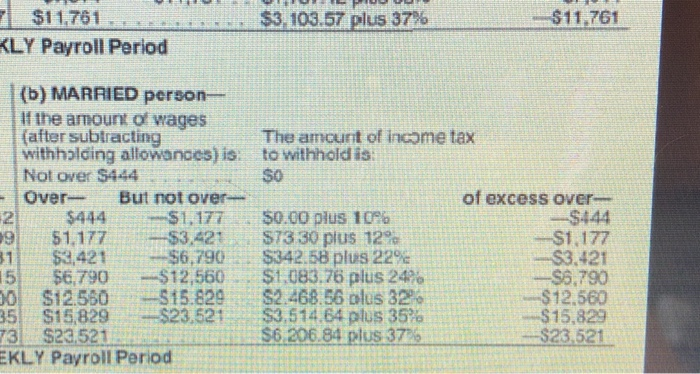

The cost-of-living increases are rounded to the nearest one-tenth of 1. The rate consists of two parts. Did you know that up to 85 of your Social Security Benefits may be subject to income tax.

Subtract the 50 taxation threshold for the individuals tax filing status from. Yes there is a limit to how much you can receive in Social Security benefits. If SS benefit exceeds 34K then taxable portion is 85 of your SS benefits.

The maximum Social Security benefit changes each year. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your.

Social Security benefits are 100 tax-free when your income is low. Couples who earn between 150000 and 250000 will receive 500 plus 250 for dependents maxing out at 750. In short Social Security carries a substantial tax advantage over other forms of income so delaying benefits in order to build a larger Social Security benefit has a greater.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. How much is the increase on benefits. If this is the case you may want to consider repositioning some of your other income to minimize.

Youd calculate the amount theyd owe taxes on this way. 2 days agoSocial Security beneficiaries who are struggling with high prices may get welcome news when the cost-of-living adjustment for 2023 is announced. While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which.

As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your. Social Security website provides calculators for various purposes. For the purposes of taxation your combined income is defined as the total of your adjusted gross.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. The AGI included in Column 1 is already reduced by the Social Security amount half of the benefit in Column 3 must be added back in. The rebate amounts decline by income until they phase out.

Must be downloaded and installed on your computer. The 2023 COLA is based on the CPI-W from the third quarter of 2022. The Senior Citizens Leagues.

Between 25000 and 34000 you may have to pay income tax on. 16 hours agoLatest News. For incomes of over 34000 up to 85 of your retirement benefits may be taxed.

The tool has features specially tailored to the unique needs of retirees receiving. Divide their Social Security benefits in half to get 6000. For 2022 its 4194month for those who retire at age 70.

How To Compute Net Pay Social Security Federal State Medical Insurance Medicare Finance Personal Youtube

Is Social Security Taxable Complete Guide Tips Inside

Will Your Social Security Benefit Be Taxed

Remitting The First Installment Of Deferred Social Security Taxes Forvis

Taxes And Social Security In 2020 Everything You Need To Know Simplywise

Resource Taxable Social Security Calculator

Calculating Taxes On Social Security Benefits

Tax Calculator 2020 Hotsell 53 Off Ilikepinga Com

Taxable Social Security Calculator

Paycheck Tax Calculator Shop 59 Off Ilikepinga Com

Calculators Social Security Intelligence

Free Tax Calculators Money Saving Tools 2021 2022 Turbotax Official

Research Income Taxes On Social Security Benefits

Solved Calculate Social Security Taxes Medicare Taxes And Chegg Com

2022 Fica Calculator Calculate Social Security And Medicare Contributions

Bland Garvey Cpa Social Security Pension Income Tax Calculator Richardson Tx

Social Security Just Emailed Us About Their Website Upgrade Here S What They Didn T Say

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)